Megan used a reconciliation worksheet – Megan’s reconciliation worksheet is a powerful tool for maintaining financial accuracy and identifying discrepancies. This comprehensive guide delves into the purpose, benefits, and steps involved in using Megan’s worksheet effectively, empowering individuals and businesses to streamline their reconciliation processes and ensure financial integrity.

Megan’s reconciliation worksheet provides a structured approach to reconciling financial accounts, ensuring that transactions are recorded accurately and that account balances are correct. It helps identify errors or discrepancies, supports decision-making, and enhances financial reporting accuracy.

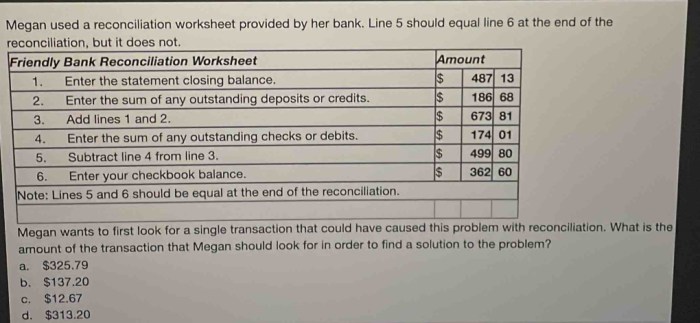

Megan’s Reconciliation Worksheet

Megan’s reconciliation worksheet is a tool designed to assist in the reconciliation of financial accounts. It provides a structured and comprehensive approach to identifying and correcting errors or discrepancies between two sets of financial records, such as a bank statement and a company’s internal accounting records.

The purpose of using a reconciliation worksheet is to ensure that the balances in the two sets of records match, and to identify any outstanding transactions or adjustments that need to be made. By using a reconciliation worksheet, Megan can improve the accuracy of her financial records and ensure that her accounts are up-to-date.

The worksheet includes several sections, including:

- Beginning balances: This section includes the opening balances for the two sets of records being reconciled.

- Transactions: This section includes a list of all transactions that have occurred during the period being reconciled.

- Adjusting entries: This section includes any adjustments that need to be made to the records to correct errors or discrepancies.

- Ending balances: This section includes the closing balances for the two sets of records being reconciled.

Steps Involved in the Reconciliation Process

The steps involved in the reconciliation process using Megan’s worksheet are as follows:

- Gather the necessary documents: This includes the bank statement, the company’s internal accounting records, and any supporting documentation for transactions or adjustments.

- Enter the beginning balances: This involves entering the opening balances for the two sets of records being reconciled into the worksheet.

- List the transactions: This involves listing all transactions that have occurred during the period being reconciled in the worksheet.

- Identify and correct errors or discrepancies: This involves comparing the transactions in the worksheet to the supporting documentation and identifying any errors or discrepancies. Once errors or discrepancies are identified, they should be corrected in the worksheet.

- Make adjusting entries: This involves making any necessary adjustments to the records to correct errors or discrepancies. Adjusting entries should be clearly documented and supported by appropriate documentation.

- Calculate the ending balances: This involves calculating the closing balances for the two sets of records being reconciled.

- Compare the ending balances: This involves comparing the ending balances in the worksheet to ensure that they match. If the ending balances do not match, the reconciliation process should be repeated until the balances match.

Common Challenges and Solutions: Megan Used A Reconciliation Worksheet

There are a number of common challenges that can be encountered when using a reconciliation worksheet. These challenges include:

- Errors in data entry: Errors in data entry can lead to incorrect ending balances and make it difficult to identify and correct errors or discrepancies.

- Missing or incomplete information: Missing or incomplete information can make it difficult to reconcile the records and identify errors or discrepancies.

- Complex transactions: Complex transactions can be difficult to track and reconcile, especially if there are multiple parties involved.

To overcome these challenges, it is important to:

- Be accurate when entering data into the worksheet.

- Gather all necessary documentation before beginning the reconciliation process.

- Break down complex transactions into smaller, more manageable steps.

Case Study: Megan’s Reconciliation Process

Megan is a small business owner who uses a reconciliation worksheet to reconcile her bank statement with her internal accounting records. Megan has been using the worksheet for several years and has found it to be a valuable tool for identifying and correcting errors or discrepancies in her financial records.

Recently, Megan noticed that her bank statement balance was not matching her internal accounting records balance. She used her reconciliation worksheet to identify the error and found that she had made a mistake in entering a transaction. Megan corrected the error and her bank statement balance now matches her internal accounting records balance.

By using a reconciliation worksheet, Megan has been able to improve the accuracy of her financial records and ensure that her accounts are up-to-date. Megan’s reconciliation process has also helped her to identify and correct errors or discrepancies in her financial records, which has saved her time and money.

Top FAQs

What are the benefits of using Megan’s reconciliation worksheet?

Megan’s reconciliation worksheet offers numerous benefits, including error identification, discrepancy resolution, improved financial reporting accuracy, enhanced decision-making, and streamlined reconciliation processes.

What are the common challenges faced when using a reconciliation worksheet?

Common challenges include data entry errors, mismatched transactions, and insufficient supporting documentation. However, Megan’s worksheet provides guidance and best practices to overcome these challenges effectively.

How does Megan’s reconciliation worksheet support financial accuracy?

Megan’s reconciliation worksheet helps ensure that transactions are recorded correctly, account balances are accurate, and financial statements are reliable. It promotes transparency, reduces errors, and enhances the credibility of financial information.