When purchasing a home, it is crucial to understand the financial implications associated with closing costs. Recurring and nonrecurring closing costs represent a significant portion of these expenses, and their impact on a homebuyer’s budget can be substantial. This article delves into the intricacies of these costs, their impact on homebuyers, and strategies for minimizing their burden.

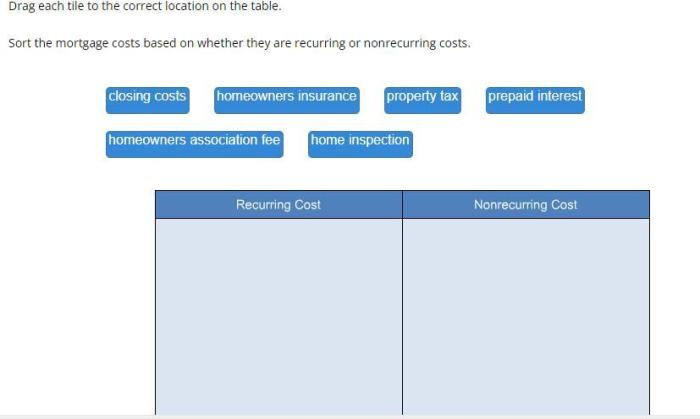

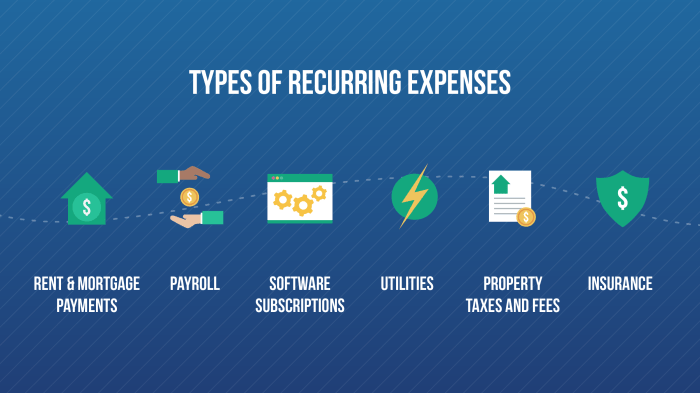

Recurring closing costs are ongoing expenses that homebuyers incur over the life of their mortgage. These costs typically include property taxes, homeowner’s insurance premiums, and private mortgage insurance (PMI). Nonrecurring closing costs, on the other hand, are one-time expenses associated with the purchase of a home.

They may include loan origination fees, title insurance, and appraisal fees.

Query Resolution: Recurring And Nonrecurring Closing Costs

What is the difference between recurring and nonrecurring closing costs?

Recurring closing costs are ongoing expenses that homebuyers incur over the life of their mortgage, such as property taxes and insurance premiums. Nonrecurring closing costs are one-time expenses associated with the purchase of a home, such as loan origination fees and title insurance.

How can I minimize the impact of closing costs?

Homebuyers can minimize the impact of closing costs by negotiating lower fees, shopping around for competitive rates, and considering lender credits or closing cost assistance programs.

What are the legal requirements for disclosing closing costs to homebuyers?

Lenders are required by law to provide homebuyers with a Loan Estimate and a Closing Disclosure that detail the estimated and final closing costs, respectively.