Current quarter’s adjustment for fractions of cents is a crucial accounting practice that ensures the accuracy and integrity of financial reporting. This adjustment rounds financial amounts to the nearest whole cent, minimizing the impact of rounding errors on financial analysis and decision-making.

Understanding the methods, accounting treatment, and disclosure requirements associated with current quarter’s adjustment is essential for accountants, financial analysts, and other stakeholders.

Definition of Current Quarter’s Adjustment for Fractions of Cents

Current quarter’s adjustment for fractions of cents is an accounting method used to round financial amounts to the nearest whole cent. This adjustment is necessary because most accounting systems cannot accurately record amounts less than one cent. Rounding financial amounts to the nearest whole cent simplifies financial reporting and analysis, making it easier to compare financial data over time and across different companies.

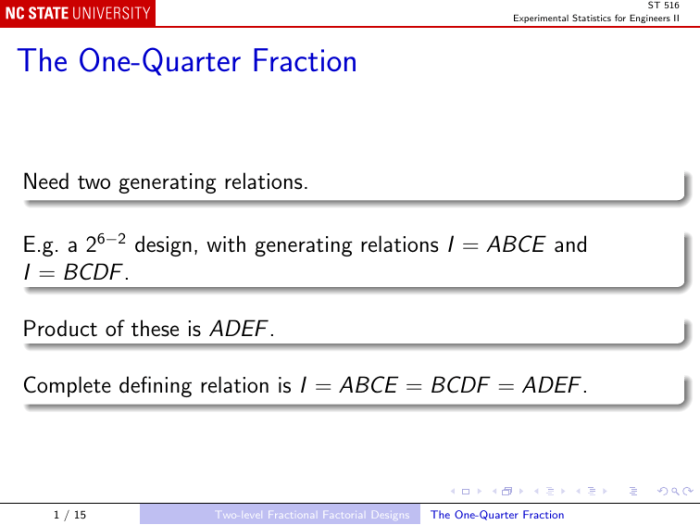

Methods for Calculating Current Quarter’s Adjustment

There are two common methods used for calculating current quarter’s adjustment: the rounding method and the truncation method.

Rounding Method

The rounding method rounds the amount to the nearest whole cent. For example, an amount of $0.005 would be rounded up to $0.01, and an amount of $0.004 would be rounded down to $0.00.

Truncation Method, Current quarter’s adjustment for fractions of cents

The truncation method simply truncates the amount to the nearest whole cent. For example, both $0.005 and $0.004 would be truncated to $0.00.

The rounding method is more commonly used than the truncation method because it is more conservative. The rounding method ensures that the total amount of the adjustment is always zero, which prevents any distortion of the financial statements.

Accounting Treatment of Current Quarter’s Adjustment

Current quarter’s adjustment is recorded in the financial statements as a separate line item in the income statement. The adjustment is typically recorded as a debit or credit to the income statement account “Current Quarter’s Adjustment for Fractions of Cents.”

The adjustment is also reflected in the balance sheet accounts, as it affects the total assets and liabilities of the company.

Disclosure Requirements for Current Quarter’s Adjustment

Current quarter’s adjustment must be disclosed in the financial statements in accordance with the relevant accounting standards. The disclosure should include the amount of the adjustment and the method used to calculate the adjustment.

Impact of Current Quarter’s Adjustment on Financial Analysis

Current quarter’s adjustment can affect financial ratios and other analytical measures. For example, the adjustment can affect the company’s gross profit margin, net profit margin, and return on assets. It is important to consider the impact of the adjustment when conducting financial analysis.

Case Studies and Examples: Current Quarter’s Adjustment For Fractions Of Cents

There are many examples of companies that have implemented current quarter’s adjustment. One example is Apple Inc. Apple Inc. uses the rounding method to calculate current quarter’s adjustment. In its 2022 annual report, Apple Inc.

disclosed that it had a current quarter’s adjustment of $0.01.

FAQ Overview

What is the purpose of current quarter’s adjustment for fractions of cents?

Current quarter’s adjustment aims to minimize the impact of rounding errors on financial reporting by rounding financial amounts to the nearest whole cent.

How is current quarter’s adjustment calculated?

Common rounding methods include rounding up amounts ending in 0.5 or greater and rounding down amounts ending in less than 0.5.

How is current quarter’s adjustment recorded in financial statements?

The adjustment is typically recorded as a separate line item on the income statement or balance sheet, depending on its materiality.